Bank of Canada Raises Benchmark Interest Rate to 3.25%

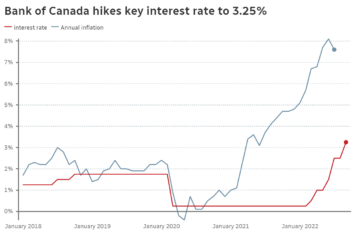

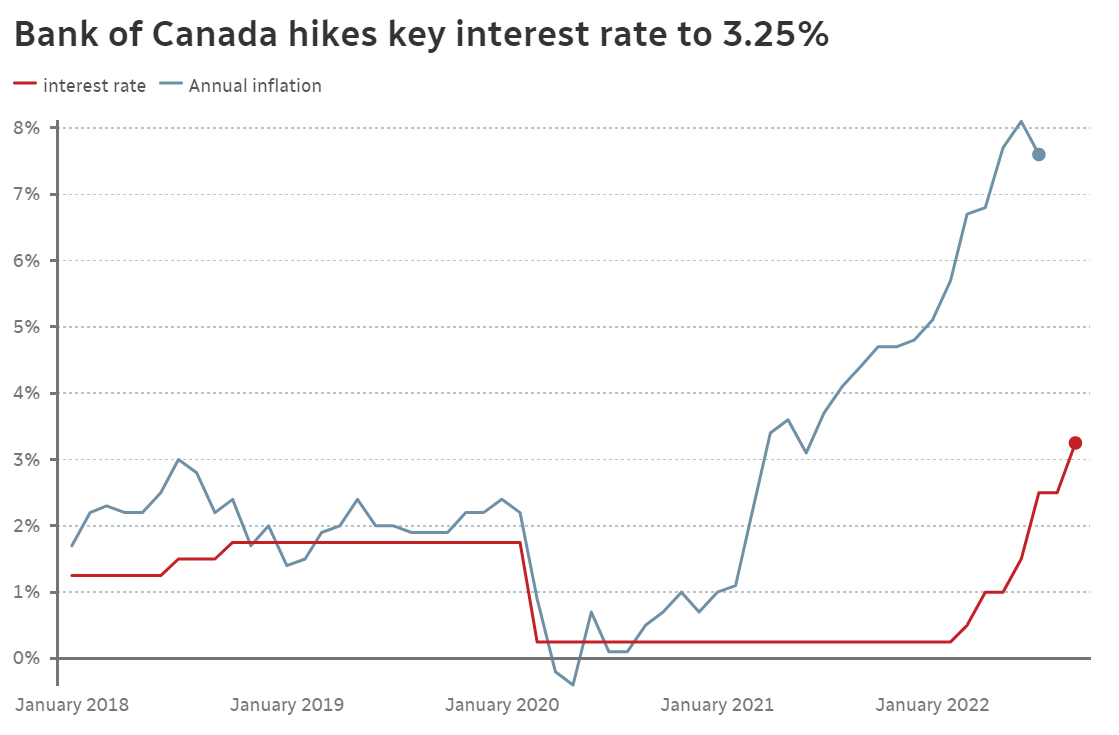

The Bank of Canada announced on Wednesday that it was hiking its trendsetting interest rate by three-quarters of a percentage point. This is the latest move by the central bank in its mission to rein in runaway inflation, which has risen to its highest level in decades.

The bank’s rate impacts the rates that Canadian consumers and businesses get from their banks on things like mortgages, lines of credit and savings accounts. At the start of the year, the bank’s rate was 0.25 per cent. After Wednesday’s move, it’s now at 3.25 per cent. That’s the highest level for the bank’s rate since early 2008, before the financial crisis.

The benchmark overnight interest rate was increased by 75 basis points to 3.25% on Wednesday by a group of policymakers led by Governor Tiff Macklem, giving Canada’s central bank the highest policy rate among the major industrialized countries. In the upcoming months, officials said they intend to keep hiking rates.

This move was widely expected by economists, and it means that anyone with a variable rate loan is likely to see their payment increase in the coming days. The bank reiterated its commitment to price stability and said that it will continue to take action as required to achieve the two percent inflation target.

The discussion now shifts to Macklem’s next steps, as the central bank attempts to determine how high borrowing costs will need to rise in order to combat sticky inflation. Markets are pricing in a strong possibility of another half-point increase in October.

While Canada’s inflation rate fell slightly from its 30-year high of 8.1 percent last month, the bank noted in its decision that the majority of that drop was due to lower gas prices, while the rest of the economy saw “a further broadening of price pressures, particularly in services.”

Chart Source : Bank of Canada

That persistent underlying inflationary pressure is a major reason why “the policy interest rate will need to rise further,” according to the bank, which also stated that it “remains resolute in its commitment to price stability and will continue to take action as necessary to achieve the 2% inflation target.”

Anyone with a variable rate loan will likely see their payment adjust in the next several days to keep up with the central bank’s move as a result of the action. RBC and TD, two of Canada’s largest banks, increased their prime lending rates by the same amount as the federal reserve on Thursday and other banks are expected to follow suit.

Since interest rates on variable rate loans increased from below two percent at the beginning of the year to over four and, in some cases, five percent today, many mortgage holders have already felt those hikes several times this year.

The majority of variable rate mortgages provide borrowers the choice to maintain a fixed payment regardless of rate changes. With rising interest rates, less of each payment is applied to principal reduction and more and more is applied to interest. Even if the size of the regular payment is the same, this lengthens the loan.

The Royal Bank of Canada, the country’s largest lender, said this week that it has around 80,000 mortgages on its books that are poised to reach their trigger point. According to the bank’s most recent letter to some of its mortgage holders, which was acquired by CBC News, “Our data show you may be approaching your Triggering Interest Rate – a moment when your regular payment is no longer enough to cover the interest portion on your mortgage.” Your mortgage payment will automatically increase if this situation arises, the letter stated.

To read more local news and updates please check our BLOG PAGE

To view Geoff Jarman’s Listings CLICK HERE